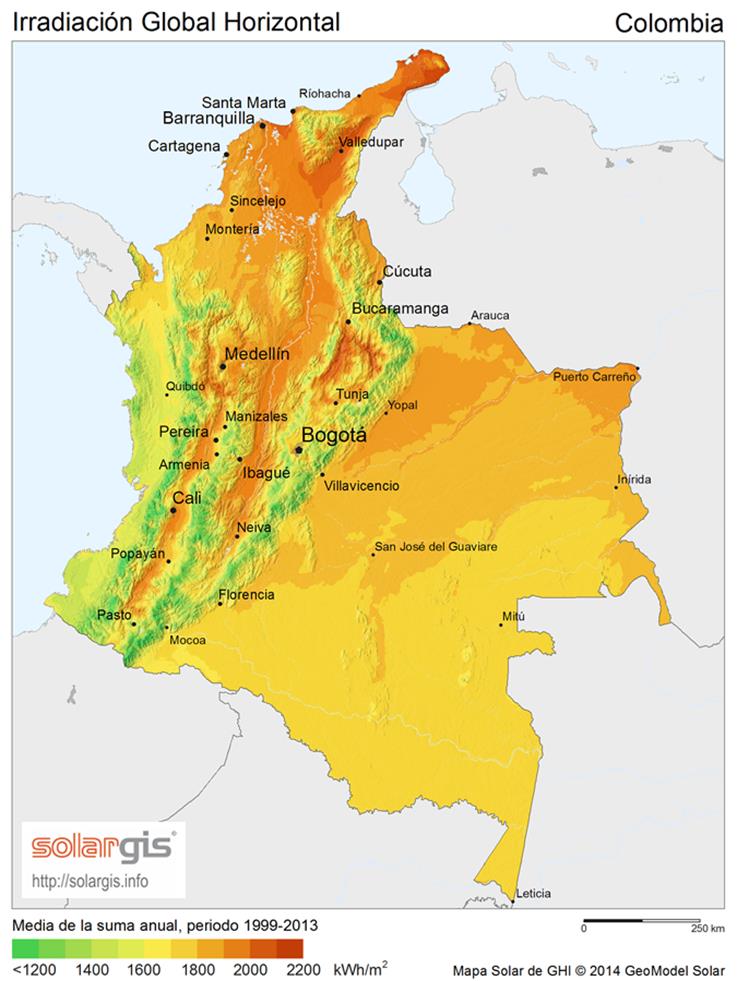

Colombia has huge potential for renewable energy. Solar irradiation levels in Colombia are among the highest on the planet, especially within the Caribbean Zone and the Orinoquia. Nevertheless, so far renewable energies contribute to less than 1 percent of national energy consumption. However, as a result of Law 1715 of the 2014 constitution, which gives tax incentives to investments in renewable energy, alternative energy projects are finally developing in the country. Solar photovoltaic technologies, in particular, will be able to profit from the new and improved framework conditions.

National Carbon Tax

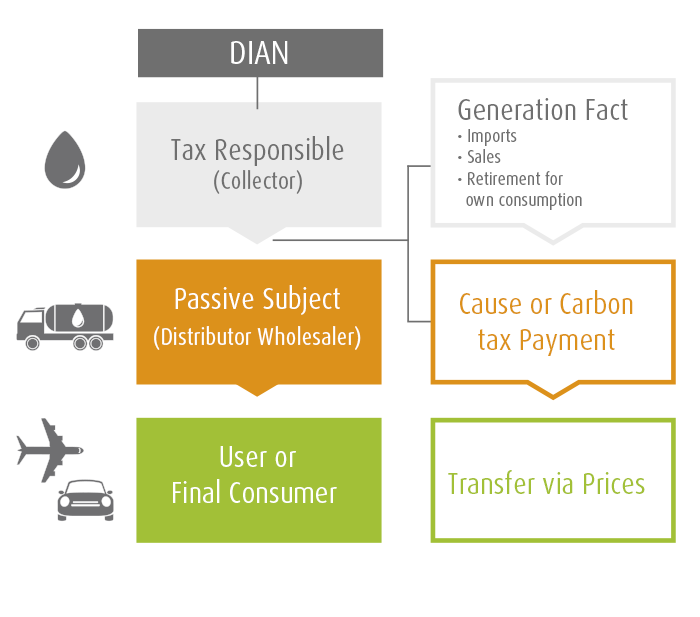

The National Carbon Tax was introduced in Colombia in January 2017, as part of the country’s strategy to address emissions reduction commitments under the Paris Agreement. The tax is applied to sales and imports of all fossil fuels, except for coal and natural gas for residential consumption. It is based on the carbon content of fossil fuels and is factored into fossil fuel prices, meaning it is paid for by consumers.

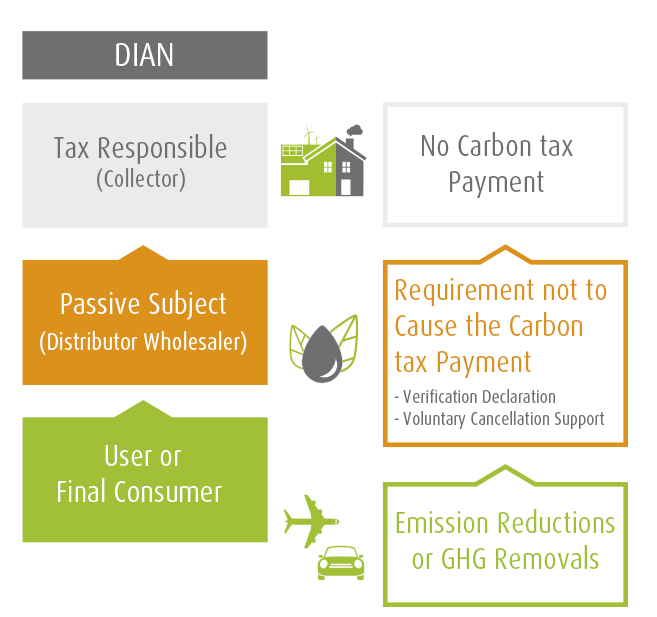

In June 2017, the Colombian government approved Decree 926 establishing the rules and conditions that allow certain entities to offset their carbon tax obligation. Companies who neutralize their carbon emissions gain access to tax breaks; this is usually done by investing into mitigation projects.

There are currently 72 CDM project activities in Colombia, yet 8 of them are inactive due to a lack of financial resources. The tax breaks incentivize companies to provide the financial means for these projects to be implemented. In turn, the companies benefit from avoiding the carbon tax.

The intention is that the carbon tax will stimulate further development and implementation of mitigation projects in Colombia.

TAX Causation

Decree 926 of 2017 Requirement to avoid the tax

Photovoltaic Energy as a GHG Mitigation Initiative

Solar Photovoltaic energy can be used to replace conventional energy from fossil fuels and is therefore an eligible technology to be used for carbon offsets in Colombia. To be eligible for use as offsets, projects must meet the following criteria outlined by the Colombian Ministry of Finance and Public Credit:

• The offsets must come from an initiative developed within national territory

• The projects must be certified by carbon standards which are recognized by the Colombian Government.

• The projects must meet the methodology requirements of the UNFCCC’s Clean Development Mechanism, REDD+ or other carbon standards that are recognized by the Colombian National Agency of Standardization

• The projects must be 100% additional

• The offsets must be registered and cancelled in a public registry to avoid double counting

Finally, to be used to avoid the National Carbon Tax, offsets must be verified by third party auditors. However, due to the decentralized and distributed nature of solar photovoltaic energy, the cost of project development, registration, monitoring and verification can present a considerable financial barrier to developers.

Solar Bonus Program for Colombian Photovoltaic Plants

Bonos Solares SAS, a subsidiary of First Climate (Switzerland) AG, has created the “Bonos Solares Program” to help overcome the challenges that solar photovoltaic installations face when it comes to transaction costs.

Photovoltaic plants enrolled onto the program are paid a “Solar Bonus” in the October of the year following the issuance of carbon offsets from the individual projects For example: a project enrolled onto the Bonos Solares Program for the year 2020 will be paid in the fourth semester of 2021.

The main conditions to access the Bonos Solares Program as follows:

Main Eligibility Criteria (Non-exhaustive)

Plant Location

Colombia National Territory

Investment start date

After October 17th 2017

Electricity Generation

Inverter output measurement (AC current) and telemetric transfer

Transfer of GHG emission reductions

Transfer to Solar Bonus Program

Plants < 15 MW (inverter output)

Registration1 without cost and guaranteed inclusion2 to Solar Bonus Program

Plants > 15 MW (inverter output)

Registration1 without cost and guaranteed inclusion2 for contracts signed before June 30th 2020

1 – Registration is the contract between the owner of the plant and the Solar Bonus Program

2 – Inclusion refers to the registration of the plant under UNFCCC CDM Executive Board

Fiscal and Financial Benefits

Registered under CDM UNFCCC

No. 10494

Bonos Solares SAS

Authorized by the Colombian Government as the Coordinating and Management Entity (CME)

Optimized Emission Reductions

Through a high grid emission factor

Solar Bonus

Attractive compensation based on plant size (#CER)3

Solar Bonus Validity

During 21 years4

Inflation adjustment

According to the inflation of the previous year plus a percentage point from year 2021 onwards

Fiscal Benefit (only for generating companies that sell the photovoltaic energy generated)

Article 99 of Law 1819 of 2016 adds article 235-2 to the Tax Statute, which refers to exempt income from taxable year 20195.

3 – CER = Certified Emission Reduction is a unit according to the Kyoto Protocol, or a unit which replaces the CER according to the Paris Agreement. 1 CER = 1 t CO2 equivalent.

4 – Validity is valid as long as there are no significant changes in the regulatory framework established by the Kyoto Protocol, the Paris Agreement and Colombia´s Tax Statute.

5 – Benefits are established for the sale of electricity generated based on wind, biomass or agricultural, solar, geothermal or the seas, according to the definitions of Law 1715 of 2014 and Decree 2755 of 2003, for a term of 15 years when it is carried out only by generating companies and the following requirements are met: Process, obtain and sell carbon dioxide emission certificates according to the Kyoto Protcol, that at least 50% of the resources obtained from the sale of said certificates be invested in social benefit works in the region where the generator operates. Such investment will be made in accordance with the impact proportion of each municipality due to the development and operation of the utility.

| Company | Project | Location

Country: Colombia |

Technology | Installed Capacity | Electricity Generation/year |

| Canadian Solar | Caracolí | Malambo, Atlántico | Photovoltaic | 52,4MWp | 109873 MWh |

| Greenyellow | Various projects including Pétalo de Córdoba | Planeta Rica, Yumbo, Rionegro, Villavicencio, Bogotá, and Barú |

Photovoltaic |

14 MW |

23445 MWh |

| SVC | Alma Solar I | Arauca, Arauca | Photovoltaic | 9,9MWp | 23261 MWh |

Remote Monitoring Co-Benefits

The plants participating in the Bonos Solares Program will receive the remote monitoring of their plant as a co-benefit. In the event that the monthly solar generation is less than 90% of the nominal generation established, the plant owner will automatically receive a warning email.